EOY GIVING RESOURCES

We want to make your end of year giving as easy and worry-free as possible, so we've compiled resources to answer all of your questions. Don't see what you need? Contact us anytime.

Hopefully we answered all of your EOY giving questions. If so, we hope you'll head back to our End of Year Giving page and make a secure donation that will change lives in India and Nepal!

Hopefully we answered all of your EOY giving questions. If so, we hope you'll head back to our End of Year Giving page and make a secure donation that will change lives in India and Nepal!

Know How to Get Your Gift in On Time

We want you to have options when it comes to end of year giving. We also want to make sure you know when the deadline for each option is in order for your gift to count towards your 2014 taxes.- Give online at our secure Donations page. Gifts must be processed by 11:59pm on December 31. This is your best last minute giving option.

- Send a check to: ServLife International, Inc. P.O. Box 20596, Indianapolis, IN 46220. Checks must be dated and envelopes must be post marked on or before December 31. Even if we don't receive the check until the new year, it will still count!

- Call or email payment information to 317-544-0484 or info@servlife.org. We'll have staff available until the end of the year to process your gifts. To keep overhead low, we maintain a small staff, which means if you call the evening of December 31, we likely won't have anyone in the office. Not to worry though! Jump back up to option #1 and give securely online.

- Donate assets through a foundation. You can give more than money. Stock, real estate, 401K rollover, business interest and other non-monetary assets can have a huge impact in India and Nepal. For more info, see the Giving Fund section below.

Understand the Basics of Year End Giving

When do I need to give by to receive a 2014 deduction? What kinds of gifts count towards a deduction? What proof do I need to claim a deduction? The IRS offers some helpful tips to answer these questions and more. Read more at IRS.gov. Forbes also offers helpful tips to make sure you've covered all of your EOY bases. Check out their 12 Tips for End of Year Giving.Maximize Your Giving Through a Giving Fund

Tax laws are often more complicated than most of us can handle. The National Christian Foundation can work with you to maximize your giving, making sure more money gets to the ministries you support and you get all of the tax benefits you are due. They can also help manage asset based gifts, such as stock, real estate, 401K rollover and business interest. Find out more at their Givers page.Get the Receipts You Need for Your Taxes

Depending on the size of your gift, you may not receive a gift receipt right away. But don't worry, we send out 2015 Giving Statements in January to all of our donors, leaving plenty of time to file your taxes.Know Where Your Gift is Going

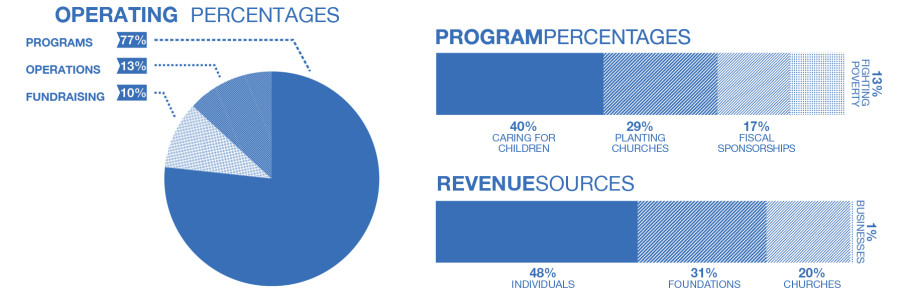

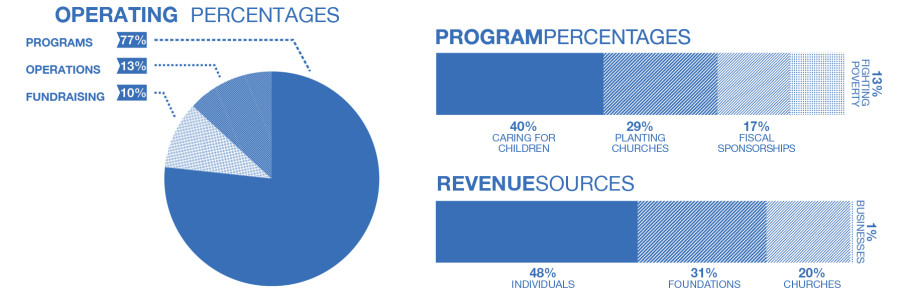

You're generously giving your hard-earned money and you want to make sure it is going where the greatest need is. We understand. We strive to keep overhead expenses to a minimum so the bulk of our funding goes directly overseas. Here's a break down of our 2014 finances: Hopefully we answered all of your EOY giving questions. If so, we hope you'll head back to our End of Year Giving page and make a secure donation that will change lives in India and Nepal!

Hopefully we answered all of your EOY giving questions. If so, we hope you'll head back to our End of Year Giving page and make a secure donation that will change lives in India and Nepal!